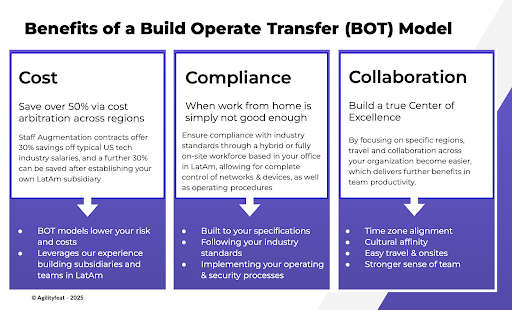

Scaling a FinTech technical team quickly, without compromising the critical priorities of operational control, security, compliance, or capacity for innovation, is essential. Latin America offers compelling cost advantages and excellent engineering talent, but the complexities of setting up a subsidiary, choosing a location, and building out your technology Center of Excellence can be overwhelming for those who have not done it before. That’s why a Build Operate Transfer (BOT) model beats traditional outsourcing. It is the smartest way for FinTechs to expand development capacity in Latin America while minimizing risk and maximizing control.

At AgilityFeat, we specialize in helping FinTechs and other tech-forward companies build secure, scalable technical teams and delivery centers in Latin America—starting as a managed operation under our care, and ultimately transferred to your ownership. This could be for your software development team, a managed services team to keep your technical operations running, or even a customer contact center.

Why Not Just Outsource?

Traditional staff augmentation can be fast—but it often falls short for FinTechs operating under strict regulatory requirements. The typical outsourcing model relies on contractors working remotely across time zones, often from their homes or coffee shops, using their own devices and networks. While this setup works for many industries, it creates significant challenges for financial services companies that must maintain rigorous data privacy, security controls, and compliance standards.

Consider what happens during a regulatory audit or SOC 2 assessment. Auditors don’t want to see that you have talented engineers—they want evidence of operational control, secure work environments, standardized processes, and documented compliance procedures. Remote contractors on personal devices accessing sensitive financial data from unsecured locations often don’t meet these requirements.

FinTechs need development capacity that scales quickly but also stands up to regulatory scrutiny. That’s where traditional outsourcing models reveal their limitations, and why a more structured approach becomes essential.

The BOT Model, Tailored for FinTech

With AgilityFeat’s BOT model, we help you:

- Build – a team of highly vetted LatAm engineers aligned with your stack and culture, along with establishing the legal and accounting operations in the chosen LatAm country so that your team will be fully compliant with local labor laws as well as your own standards and policies.

- Operate – a secure Delivery Center or hybrid workspace that we manage in full compliance with your policies. We manage this transparently with you so that your team learns how to oversee operations. We will also hire and onboard your own local operations management team so that it’s ready to be transferred to you.

- Transfer – full control of the operation to your company once it’s stable and you are ready. In our standard model for US clients, this includes the LatAm subsidiary, and a US based LLC which owns the subsidiary, so that you receive the full LatAm operations, banking, and legal setup, while making a simple purchase agreement entirely based in the US.

The result is a nearshore Center of Excellence that gives you the oversight and compliance posture you need—without the cost or complexity of going it alone.

Security and Compliance: A First-Class Citizen

In a BOT engagement, we help you set up device controls, secure networks, and in-person or hybrid office policies that ensure your team is audit-ready. Whether you need to meet SOC 2, ISO, or regional regulatory requirements, our process is designed to embed those needs from day one.

This gives your security and finance teams the confidence they need—something that’s hard to replicate in traditional contractor models.

Latin America: The Smart Nearshore Option

With excellent engineering talent, cultural affinity, and time zone alignment with U.S. teams, Latin America is already a top nearshoring destination. Our BOT approach turns that into a long-term strategic advantage, helping you create a local presence without the risk of permanent overhead until you’re ready.

AgilityFeat can help you establish operations in the country of your choice, but for FinTechs we would particularly recommend Colombia or Panamá. We already have our own subsidiaries in both countries, as well as all the legal, accounting, and real estate relationships necessary to smoothly set up your operations.

Given Panamá’s unique position as a financial hub for LatAm, and its strong relationship with the US, Panama City offers a natural location for FinTechs and a workforce used to working in banking and FinTech. It’s a strong location to consider for any technical team for a FinTech, and particularly well suited for FinTech contact centers.

Colombia offers a larger tech community, which can be an advantage for software delivery teams, AI engineering teams, or managed support teams and technical support operations. Bogotá and Medellín are both large markets which have already been selected by many large US tech companies for their LatAm offices, and other Colombian cities like Cali, Cartagena, and Barranquilla also offer rapidly growing tech communities at very competitive pricing.

Meet Us at the FinTech & Insurtech Generations Conference!

If you’re attending the Fintech and Insurtech Generations Conference in Charlotte, North Carolina on June 11-12 2025, let’s meet up! For those exploring how to scale FinTech teams with more security and control, while still leveraging cost savings, it will be a valuable conversation. We’d love to share how AgilityFeat’s BOT model can help you build the Center of Excellence your product—and your compliance auditors—will love.

Email me to request a meeting in Charlotte or fill out our contact form to learn more about how we can help you to build your LatAm technical delivery center!